Bikash Prasad, President & CFO at Olam Agri - a global agri-business headquartered in Singapore - is a qualified Cost and Management Accountant from India. His academic records include an award by the finance minister of Delhi at Vigyan Bhawan, New Delhi for being all India topper (Intermediate) in the examination of the Institute of Cost Accountants of India, He has over 25 years of experience in global environment and has led the group on a Private Placement in a landmark USD 3.5 billion equity valuation transaction, Corporate Restructuring and Carve-outs of the Group into separate operating groups involving 250+ subsidiaries, IPO readiness for potential dual- listing, Board and SGX reporting, Strategic Planning, Finance and Digital Transformation 2.0 to achieve Next-in-Class business partnership.

In an exclusive interaction with Finance Outlook India, Bikash Prasad, President and CFO of Olam Agri, delves into the importance of unlocking shareholder value through strategic corporate restructuring:

What are the primary considerations for a company when deciding to pursue a business carve-out, and how does this decision align with the goal of maximising shareholder value?

When pursuing a business carve-out, companies must consider factors like financial performance, strategic-fit, and potential market valuation of the carved-out entity. Operational readiness for separation, including resource availability and the capability to operate independently, is also crucial.

A carve-out is often driven by the goal of unlocking value within a diversified conglomerate. By divesting non-core assets, a company can focus on areas where it holds competitive advantages, enhancing efficiency and capital allocation.

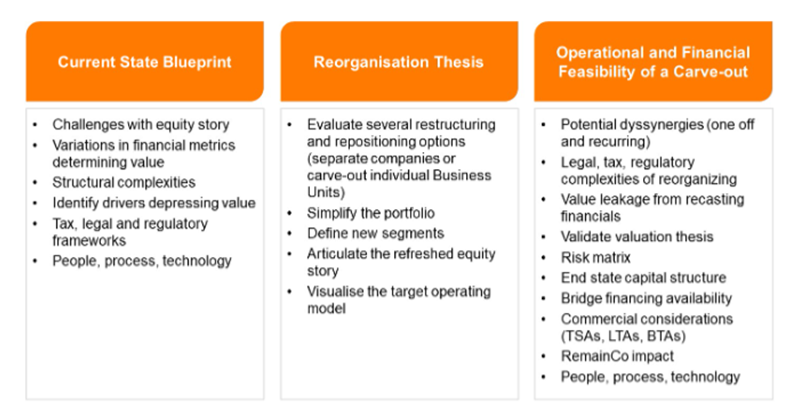

The decision to undertake such a move typically stems from identifying a problem or opportunity, followed by ideation to determine the most effective solution. This involves assessing what actions are needed to sustain and optimize value. Financial metrics of individual business units help highlight performance variations that affect collective value, while market perception, including comparable company multiples, provides further validation.

A strategic refocus of business units can unlock growth, attract investors, and reposition the company’s portfolio, generating sustainable growth and consistent returns for shareholders. The "HOW" involves strategic insight, collaboration, and addressing business-specific factors to ensure the carve-out’s success.

In 2020, Olam Group restructured its diverse portfolio into three distinct operating groups: (1) ofi, a global leader in ingredients, (2) Olam Agri, a market-leading global agri-business, and (3) the Remaining Olam Group, focused on divesting non-core assets and nurturing gestating businesses. This reorganization unlocked significant value, reflected in an increase in the Price to Book ratio from 0.8x at the Group level to 3.5x for Olam Agri post-restructure and a US$ 3.5 million equity valuation private placement. This case highlights how strategic carve-outs can drive value and improve performance by focusing on core operations.

Companies should invest in Initial Public Offering communications at least one to two years before the float, as foundational communications need to be in place long before the PR campaign begins.

How can organisations effectively identify underperforming or non-core assets suitable for carve-outs, and what metrics or benchmarks are commonly used in this evaluation?

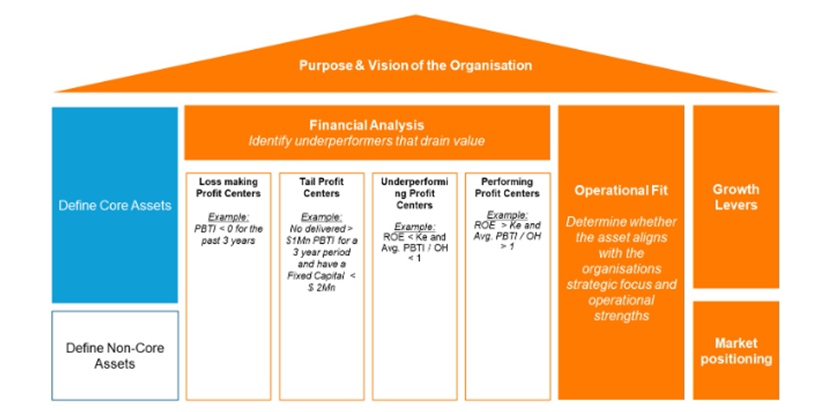

To identify underperforming and non-core assets, companies must use the right metrics and benchmarks to evaluate business units' performance. This includes conducting a comprehensive portfolio analysis, assessing strategic fit and financial health. Key financial metrics—such as revenue growth, EBIT, EBITDA, return on assets (ROA), return on equity (ROE), and cash flow—gauge profitability and performance. These should align with business-specific needs and integrate operational metrics like productivity, cost efficiency, market share, and positioning. A comparative analysis with industry peers provides additional context. By combining financial and operational data into a balanced scorecard, companies can identify potential carve-outs. Additionally, scenario analysis and predictive modeling help assess the impact of asset divestment, ensuring alignment with broader goals.A framework to guide executives should be utilised to identify assets suitable for a business carve-out.

In preparing for an IPO, what are the critical financial and operational restructuring steps that companies should prioritise to ensure optimal valuation and regulatory compliance?

The current legal structure of a company plays a crucial role in determining the steps required for a successful IPO. Key factors such as whether the company is part of a publicly listed group, the jurisdiction of the listing, and the proposed IPO jurisdiction will influence the necessary actions. While the IPO process is generally similar across jurisdictions, regulatory differences can significantly affect preparation complexity.

Step 1: Reorganisation

Reorganisation is essential for preparing a company for an IPO by optimizing its operational structure. This involves identifying underperforming assets, distinguishing core from non-core assets, and regrouping core assets into cohesive segments aligned with market trends. The company must create new reporting segments and financial metrics to offer a clearer view of performance. A targeted operating model is developed, and dedicated leadership teams are assigned to each segment. This restructuring enhances market positioning, improves efficiency, and aims to achieve the best possible valuation.

Key Considerations:

· Balance and optimise the business portfolio, on market trend with a suitable peer group

· Establish benchmarks for evaluating one-time and recurring dyssynergies

· Create pre-IPO and model post-IPO operating entity financial profiles

· Capital structure current and end state assessment

· Funding plan to achieve target capital structure

· Identify and track issues that could have an impact on the valuation

Step 2: Carve-out and Separation

With a demerger and IPO on the horizon, the legal carve-out and separation must be structured to support the proposed listing. A scheme of arrangement or top-hatting will be used to reorganize capital, assets, or liabilities, easing complexities from restructuring. Under a scheme of arrangement, the company presents a plan that requires shareholder or creditor approval and court sanction. Once approved, the scheme becomes binding on all parties, providing a legally endorsed pathway for corporate restructuring.

Key Considerations:

· Subsidiary restructuring: Country level mixed entity separation, new entity registration and transfer of assets

· Contracts, IP, and licenses: Contracts novation, license transfers and IP distribution

· Functional readiness and TSAs: Scope of long term and transitory services and agreements

· Finance, Tax and Treasury: Debt and tax restructuring, split financials and independent funding lines set up.

· Technology and Data: Separation of data, apps, systems, and user access

· People and Organisation: Org redesign, change management and key talent retention.

· Carved out historical financials excluding one-offs; carry out audits on these financials

· Design the Target Operating Model for the new operating groups

Step 3: Valuation and Listing Venue Analysis

Repositioning the group with a strategic focus unlocks hidden value across the organization. Identifying the right peer universe guides the appropriate valuation methodology for the refreshed groups. Understanding how brokers and analysts apply valuation methods, such as DCF, SOTP, P/E, or EV/EBITDA, is crucial. Once the methodology is determined, a detailed analysis of potential listing venues follows, considering key metrics. The IPO listing jurisdiction depends on market size, relevant peers, and the number of IPOs. Additionally, domestic investor and analyst perceptions of the business model and growth potential are critical to achieving an optimal valuation.

Key Considerations:

· Identify comparable companies, primary and secondary peers

· Evaluate intrinsic vs market value of peers

· Understand broker/analysts target price valuation methodology for peers

· Analysis of potential listing venues: size of IPO, liquidity and valuation of exchange, market depth, regulatory and execution factors, buyside and sell side understanding of business model and sector, attractiveness of investor base, primary vs secondary listing options

Step 4: Demerger and IPO

The final stage involves ensuring Initial Public Offering readiness by finalizing strategic and operational changes, solidifying financial health, and establishing strong corporate governance. A pre-IPO market assessment gauges investor sentiment, while pre-roadshows help assess market appetite and gather feedback, ensuring alignment with market expectations and regulatory compliance.

Key Considerations:

· Financial Readiness: Ensure the financial statements are audit-ready and reflect the restructured entity accurately

· Legal Preparedness: Address all legal considerations, including ensuring that all IP rights, contracts, and other legal documents are compliant with the listing requirements

· Identify Joint Book Runners, Joint Global Coordinators, and IFAs; subsequently finalise issue managers and lead managers.

· Structure the IPO; dual, concurrent, sequential listing; issuance of shares and depositary receipts.

· Develop the IPO prospectus.

· Roadshows to communicate the equity story, financial performance, outlook and key messages to analysts and investors; this will support the development of research reports from the analysts to provide potential investors a view on the growth story of the company.

· Establish mix of target investors including cornerstone investors (to secure commitment), institutional investors, or retail investors

· Design the bookbuilding process and price stability mechanism; greenshoe which allows underwriters to sell more shares than initially planned if demand for the shares exceeds expectations – a tool utilized to prevent the stock price from falling below the offering price.

· Demerger agreement for the carve-out entity.

What role does communication with stakeholders, including shareholders and employees play in the restructuring and IPO process, and what strategies ensure transparency and support for the initiative?

Companies should invest in Initial Public Offering communications at least one to two years before the float, as foundational communications need to be in place long before the PR campaign begins. IPO stakeholder engagement is not just about raising capital; it’s about building trust, managing expectations, aligning interests, and ensuring a smooth public transition. A key consideration is for companies to clearly communicate who they are, how they will use the funds raised, and their future goals. Consistent, transparent messaging to stakeholders - including investors - helps shape a positive perception of readiness for public trading. Identifying risks, challenges, and opportunities is crucial to fostering trust, while keeping stakeholders informed and engaged at key milestones ensures involvement and alignment.

A key aspect of the IPO communications strategy should be ensuring that the CEO and CFO enjoy strong visibility in the marketplace and are positioned as thought leaders. Maintaining a consistent narrative across all communication touchpoints is vital, ensuring each message aligns with the company’s theme. Cultivating relationships with media, investors, and industry leaders is an ongoing process. Employees, as key assets, may have concerns during restructuring or excitement about IPO opportunities. Engaging with them early and addressing concerns secures support. Offering formal support, like stock option education, enhances motivation and inclusion. Transparent, timely communication with stakeholders is essential for a successful restructuring and IPO, fostering trust, alignment, and long-term success.

How can companies balance the costs associated with carve-outs and IPO preparations with the anticipated benefits, and what are effective ways to measurethe impact on shareholder value post restructuring?

Carve-out and Restructuring Costs

An IPO journey involves carve-outs and restructuring, incurring costs but offering opportunities to refine strategies and enhance operational focus.

Key costs associated with carve-outs and restructuring include:

· Dyssynergies from Separate Systems: Establishing separate systems for newly distinct business units often leads to temporary inefficiencies and increased operational costs.

· Separate Businesses: Managing and integrating separate businesses requires additional administrative and operational efforts, which can be resource intensive.

· Treasury and Profit Planning: Dedicated treasury functions and profit planning mechanisms must be set up, adding to the financial burden during the transition phase.

· Negotiations with Suppliers: Re-negotiating contracts and supply agreements can lead to temporary disruptions and higher costs.

Despite the associated costs, carve-outs and restructuring yield substantial benefits, including:

· More Focus on Redefined Targeted Growth: By focusing on core competencies and growth areas, companies can optimize their strategic direction.

· Efficient Capital Structure: Restructuring allows for the realignment of capital structures to better support business objectives and attract investors.

· Attracting the Right Investors: A clear equity story and refreshed strategy can attract investors who are aligned with the company’s vision and goals.

· Continuity and Performing Businesses: Ensuring continuity in operations while enhancing business performance leads to sustained growth and profitability.

· Right Profit and Valuation: Achieving the right profit margins and valuation benchmarks enhances the company’s financial performance and market perception.

IPO Costs and Benefits

Typically, the cost of an IPO ranges between 4-6% of the IPO size, including underwriting fees, advisors’costs, regulatory expenses, and other associated costs. There are, however, significant and tangible benefits the companies stand to capitalise from with an IPO:

· Right Valuation: Achieving accurate company valuation through market mechanisms.

· Growth Capital Deployed: Access to capital for expansion and strategic investments, thereby improving margins and profitability

· Direct Contribution to Bottom Line: Enhanced financial performance due to increased capital and operational efficiencies.

· Reputational Capital Increase: Improved market reputation and brand value.

· Diversified Set of Investors: Broader investor base leading to enhanced liquidity and market reach.

· Employee Stock Options and Grants: Offering ESOS and grants to employees can boost morale and align interests with company goals.

· Tapping into Newer Markets: Expanding market presence and exploring new growth opportunities.

Impact on Shareholder Value

Measuring the impact of restructuring and IPO on shareholder value is crucial for assessing the success of these initiatives. Effective methods include:

· Valuation Range Using Comparable Transactions: Benchmarking against similar transactions to determine a fair valuation range.

· Intrinsic Value: Assessing the intrinsic value of the company based on fundamental financial metrics and potential growth prospects.

· Share Price Led Valuation: Evaluating the company’s valuation based on current and projected share prices in the market.

· Earnings Per Share (EPS): Monitoring EPS as a key indicator of profitability and value creation for shareholders.

In conclusion, while carve-out and IPO preparation costs are significant, the strategic benefits and improved financial performance outweigh them, ensuring sustained shareholder value and long-term success through effective valuation and balance.

Awards & Accolades

Bikash has received several personal recognitions in his promising professional career:

- CFO of the Year 2024 by UBS Forum in Dubai

- Commercial Leader of the Year 2023 by Tiger Hall in Singapore,

- CFO of the Year” award in 2016 by the CFO South Africa forum

- Observer” seat at “Professional Accountants in Business Advisory Group” with International

Federation of Accountants (IFAC)

- IFAC featured Olam Agri Finance as an example through publication of case studies on “Role

of Finance in driving sustainability” and “Transition from CFO to CVO Mindset”

- International Speaker at the World Congress of Accountants- 2022, IFAC PAIBAG in New York – 2023, GloPAC-2023 by ICAI, Resolve-2023 by ICAI in Singapore, National Cost and Management Accountants convention, 2024 by ICMAI

- Guest faculty at top B-Schools and academic institutions