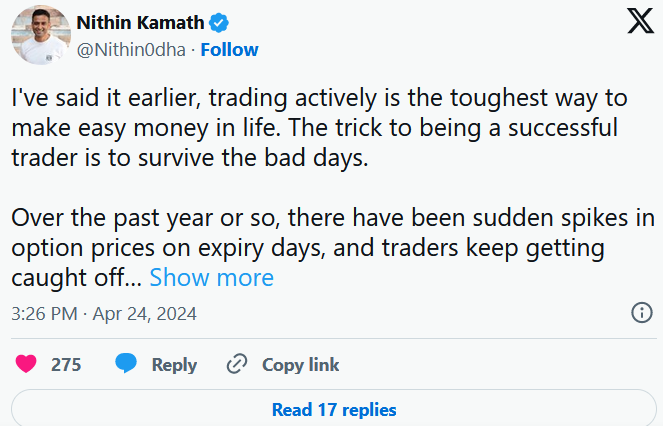

Active trading might be a winner-take-all scenario. In a post on X, Zerodha Co-founder Nithin Kamath describes it as the most difficult way to make cheap money, citing the abrupt surges, particularly on expiry days.

"The trick to being a successful trader is to survive the bad days," he writes in his book.

So, how do you keep put without losing your shirt? "One way to ensure you don't lose money due to volatility is to trade fully hedged options strategies, such as spreads," Kamath explains. "Of course, this alone will not suffice. You should also verify that you have risk-management procedures in place and that your positions are adequately sized," he says. Kamath posted Sensibull's post on how to employ fully hedged option strategies such as spreads.

The essay discusses methods including the Bull Call Spread, Bear Put Spread, and Iron Condors that provide less trading heartburn.

"The loss is limited, if you trade a spread, such as a bull call spread or a bear put spread, no matter what the market does, your losses will not exceed a fixed number," the write-up states. However, retail traders must realize and be educated on the fact that an algorithm or a specific strategy does not always produce results. Retail investors account for around 35% of option trading in India.

According to a Sebi survey conducted in the fiscal year 2021-22 (FY22), about 90% of active traders suffered losses, with the average being Rs 125,000.

The average net loss of these 90% individuals was more than 15 times that of the 10% who made a profit. Despite the risks, the allure of India’s market potential remains strong for both domestic and foreign market makers.

“The driving force is the liquidity that is now available in India,” Vaibhav Sanghavi, a hedge fund manager at ASK Investment Managers in Mumbai told Bloomberg. “It has become one of the only markets besides the US that can offer the kind of opportunity.”