Moneykonnect is about more than managing finances, it's about building trust, creating value, & helping people achieve their dreams

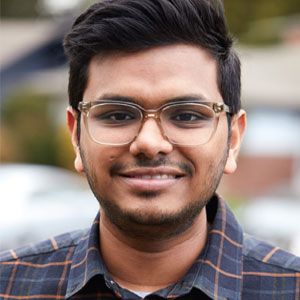

Jitendra Tayal, Chief Finance Coach

Jitendra Tayal,Chief Finance Coach, Moneykonnect

In India’s rapidly evolving treasury and cash management sector, the need for innovative, tailored financial solutions has never been greater. As a result of technological advancements, favorable demographics, and economic growth, financial service providers now have the opportunity to meet a wide range of client needs. With a GDP per capita exceeding $2,300, India is at a turning point in its economic development and is drawing a lot of young, ambitious investors looking for cutting-edge financial solutions.

The recent fintech boom has democratized access to financial services, with large scale Exchange Only Platforms (EOPs) as well as financial wealth aggregators has led fintech innovations empowering investor access across the nation. This surge in activity is evident in India’s record-breaking ₹418.87 billion in new investments in October 2024, reflecting growing investor confidence. Yet, the abundance of conflicting financial advice from social media and traditional sources leaves many investors confused, emphasizing the need for clear, expert and reliable guidance.

Moneykonnect is a legacy-driven wealth management firm with over three decades of expertise. It was founded by Jitendar Tayal, a pioneer in India’s financial services sector. Beginning his journey at the Delhi Stock Exchange, Jitendar built the firm from the ground up, establishing one of the country’s first mutual fund marketing and distribution desks. Today, Moneykonnect specializes in treasury and cash management for institutions and individuals, addressing diverse financial needs with precision and care.

“Information overload from the media, influencers, and conflicting financial advice are some of the major obstacles that contemporary investors must overcome to avoid confusion and making poor decisions. We address these obstacles by focusing on principles such as risk assessment and asset allocation that are customized to each person's financial objectives and behavioral patterns”, asserts Jitendra Tayal, Chief Finance Coach, Moneykonnect..

Using a client-focused strategy, Moneykonnect establishes itself as a reliable partner, helping customers make well-informed and well-balanced financial decisions to succeed over the long run. “Our approach is highly tailored to each client's unique risk profile and financial goals. One example is the core and satellite strategy, where we allocate a stable, long-term ‘core’ portion of the portfolio and a tactical ‘satellite’ portion for more dynamic, opportunistic approaches, ensuring both capital preservation and growth”, adds Mrigank Tayal, Designated Partner, Moneykonnect.

The investment landscape offers a comprehensive range of options across the risk-return spectrum, catering to diverse financial goals. It begins with safe and stable instruments like traditional fixed deposits (FDs), progressing to corporate FDs that offer slightly higher returns for a modest increase in risk.

Mutual funds serve as a versatile asset class, blending defensive and growth strategies across various categories. They provide an excellent mix of stability and potential upside, making them suitable for both conservative and aggressive investors. Beyond mutual funds, portfolio management services (PMS) and alternative investment funds (AIFs) occupy the alternate investment space. These products come with a higher risk-reward tradeoff compared to FDs, mutual funds, and commodities like gold and silver, appealing to investors seeking customized strategies and superior returns.

For those looking to explore even more advanced opportunities, venture capital (VC) funds, private cap table placements, and other niche products offer access to high-growth potential. These options span sectors ranging from niche markets in India to broadbased themes in international locations such as the U.S. and beyond, providing exposure to cutting-edge innovations and global investment opportunities.

Moneykonnect specializes in guiding foreign nationals and non-resident individuals (NRIs) by capitalizing on emerging opportunities such as GIFT City, India’s innovative tax-friendly zone designed to rival international hubs like Singapore and the Cayman Islands.

Mrigank Tayal, Designated Partner

Mrigank Tayal, Designated Partner

For clients with specific needs, the firm also facilitates investment routing through other established international tax havens, including Singapore and Hong Kong, offering tailored solutions that align with their global financial goals.

Building a Legacy

Initially established as Tayal Capitals, Moneykonnect started as a one-man army, as a part-time business and a sole proprietorship establishment. As time went on, the company grew into a strong business with a vibrant 10-person staff under the tutelage of Jitendar and Mrigank. Mrigank has over ten years of experience as a data scientist in the United States working with multinational behemoths such as Amazon and Facebook as well as early stage startups based in Bangalore.

Currently, the firm provides its services to more than 3,000 clients in India and other countries, including but not limited to Bangladesh, Nepal, the United States, Canada, Germany, Russia, Netherlands, Singapore, Hongkong. With a strategic growth focus, Moneykonnect intends to continue providing valuedriven financial solutions by strengthening its position in important global markets and using its experience to grow geographically.

“We’re proud to have a core team of ten highly committed professionals, with some bringing over 20 years of expertise to our firm. We’ve made it a priority to align team members with specific client needs, ensuring personalized and thoughtful solutions. As part of our growth strategy, we’re also onboarding experienced relationship managers to enhance our ability to serve our high-net-worth clientele,” shares Mrigank.

He highlights a broader organizational shift toward building a more employee-centric and culture-driven workplace. “We’re fostering a supportive environment where our team feels valued and empowered. This isn’t just about improving internal morale, it’s about ensuring our clients benefit from a motivated and inspired team”, he adds. By embedding this ethos into the company’s DNA, Mrigank envisions a sustainable path to growth that strengthens both employee engagement and customer satisfaction.

The Robust Way Ahead

The company intends to enhance its standing as a reliable partner by guaranteeing that customers receive customized financial solutions that satisfy their requirements and promote enduring loyalty. Currently holding ₹650 crores in assets under management (AUM), Moneykonnect wants to increase its portfolio fivefold by the end of the decade and expand into new markets and regions.

With a strategic focus on expanding its international clientele, Moneykonnect leverages GIFT City as a gateway for seamless and tax-efficient investments. The company also intends to onboard more institutional clients by using its experience in cash and treasury management to serve a wider array of businesses.

.jpg)