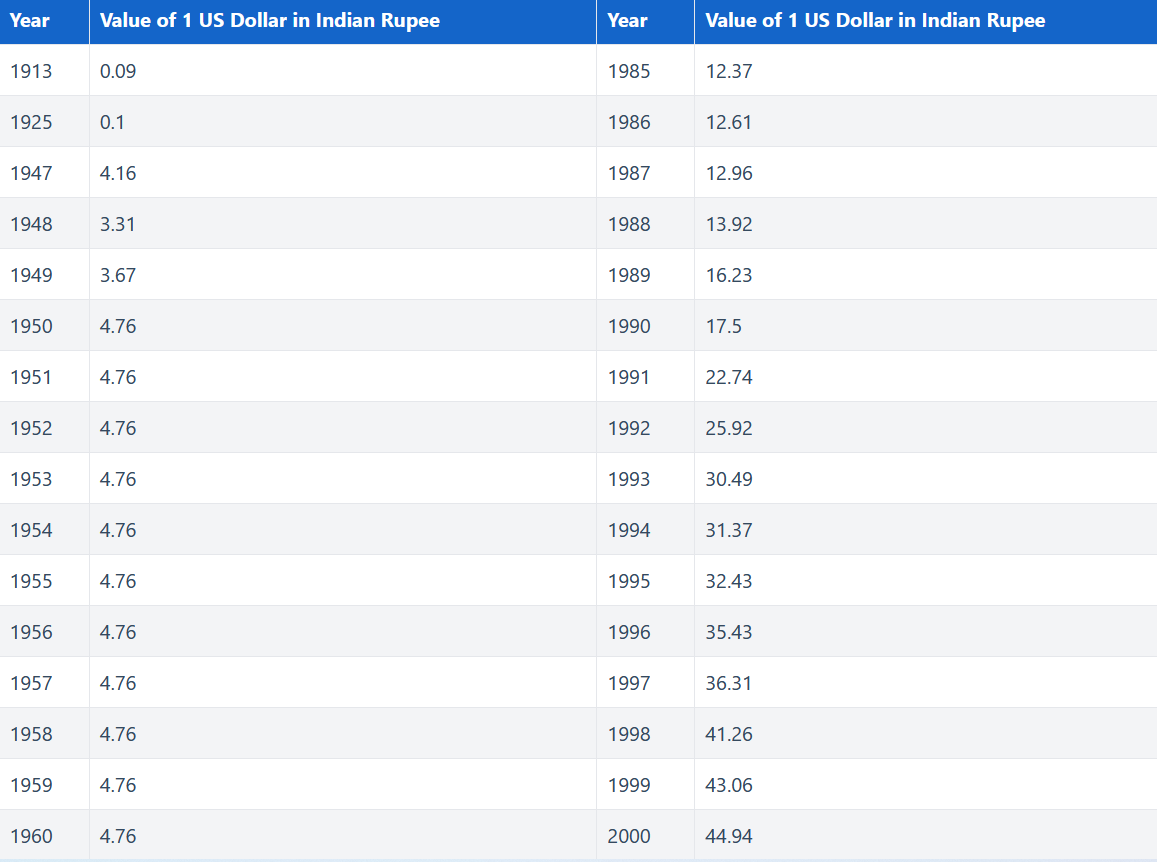

In the year 1947, the value of 1 USD in Indian rupee was 4.16. However, over the years, the difference started scaling. And if we look over the past few months, we are witnessing the Indian rupee hitting an all-time low against the US dollar, breaching the Rs 85 mark for the first time ever. So, what’s driving this sharp decline? The answer would be a cocktail of global economic shifts, Federal Reserve policies, which is further coupled with India’s own economic headwinds; thereby pushing INR into uncharted territory. And as the dollar strengthens and investor sentiment wanes, the roadmap ahead for the rupee still looks uncertain. So, the biggest question here would be - is this a temporary setback or a sign of deeper trouble for India’s so called burgeoning economy?

Let’s unravel the story behind the slide:

The rupee dropped to an all-time low against the US dollar on Thursday, shattering the Rs 85 threshold for the first time. This decrease comes after the US Federal Reserve reduced key interest rates by 25 basis points and signaled fewer rate reductions in 2025, placing extra strain on the currency, which was already under pressure owing to sluggish capital inflows and other economic issues.

The rupee fell to 85.0650 against the US dollar in early trade, from 84.9525 on Wednesday. The rupee's devaluation has quickened recently, with the decline from Rs 84 to Rs 85 taking only two months. If we compare, the currency fell from Rs 83 to Rs 84 in 14 months, and from Rs 82 to Rs 83 in 10 months. However, the rupee's loss is not a unique incident as other Asian currencies are also falling as the year end nears. The Korean won, Malaysian ringgit, and Indonesian rupiah all declined by 0.8 percent to 1.2 percent on 19th December 2024.

The sell-off in Asian currencies followed the Federal Reserve's most recent policy recommendations. The Fed's "dot plot," which illustrates its rate predictions, now shows only two rate cuts in 2025, half of which was previously announced in September. The words of Federal Reserve Chairman Jerome Powell added to the market's caution. He went on to say, "From here, it's a new phase, and we're going to be cautious about further cuts."

To give you a context, here below is the valuation of 1 USD in Indian rupee till 2000:

What drives the fall?

The rupee's decline has been fueled by a combination of global and domestic forces. India's economic growth dropped to a seven-quarter low in July-September, and the merchandise trade imbalance widened. Furthermore, capital inflows into the country have also remained modest while the persistent appreciation in the US dollar has exacerbated the rupee's problems. Additionally, expectations of vigorous US economic policies have kept the dollar strong, and the Fed's latest advice is expected to add to its value.

In addition India's faltering economic development has also fueled speculation that the Reserve Bank of India (RBI) may need to slash interest rates soon, further putting downward pressure on the currency. According to Akshay Kumar, Head of Global Markets at BNP Paribas India, "In the short term, we can expect upward pressure on USD/INR to remain."

The rupee's tough environment has caused investors to increase their short holdings to a two-year high, according to a recent Reuters poll. The rupee has already dropped by 2% this year, putting it in the middle of the pack among Asian currencies.

What are the steps in mitigating this ongoing downfall?

To mitigate the situation, the Reserve Bank of India (RBI) has increased its dollar sales in the forwards market to support the weakening rupee, which hit a record low of 85.0750 against the U.S. dollar. In the last two trading sessions, the RBI conducted buy-sell swaps worth USD 3 billion to USD 4 billion, primarily in the mid-to-far tenors. This intervention strategy aims to limit the impact on banking system liquidity and foreign exchange reserves, as selling dollars in the spot market would deplete reserves and reduce rupee liquidity. The RBI's move comes after challenges in using the non-deliverable forwards (NDF) market, where its large position made interventions trickier. The rupee's decline is attributed to the U.S. dollar's strength, India's slowing growth, and a widening trade deficit.

Despite routine interventions by the Reserve Bank of India to steady the currency, many anticipate the rupee's recent low volatility will remain persistent as we move into 2025.